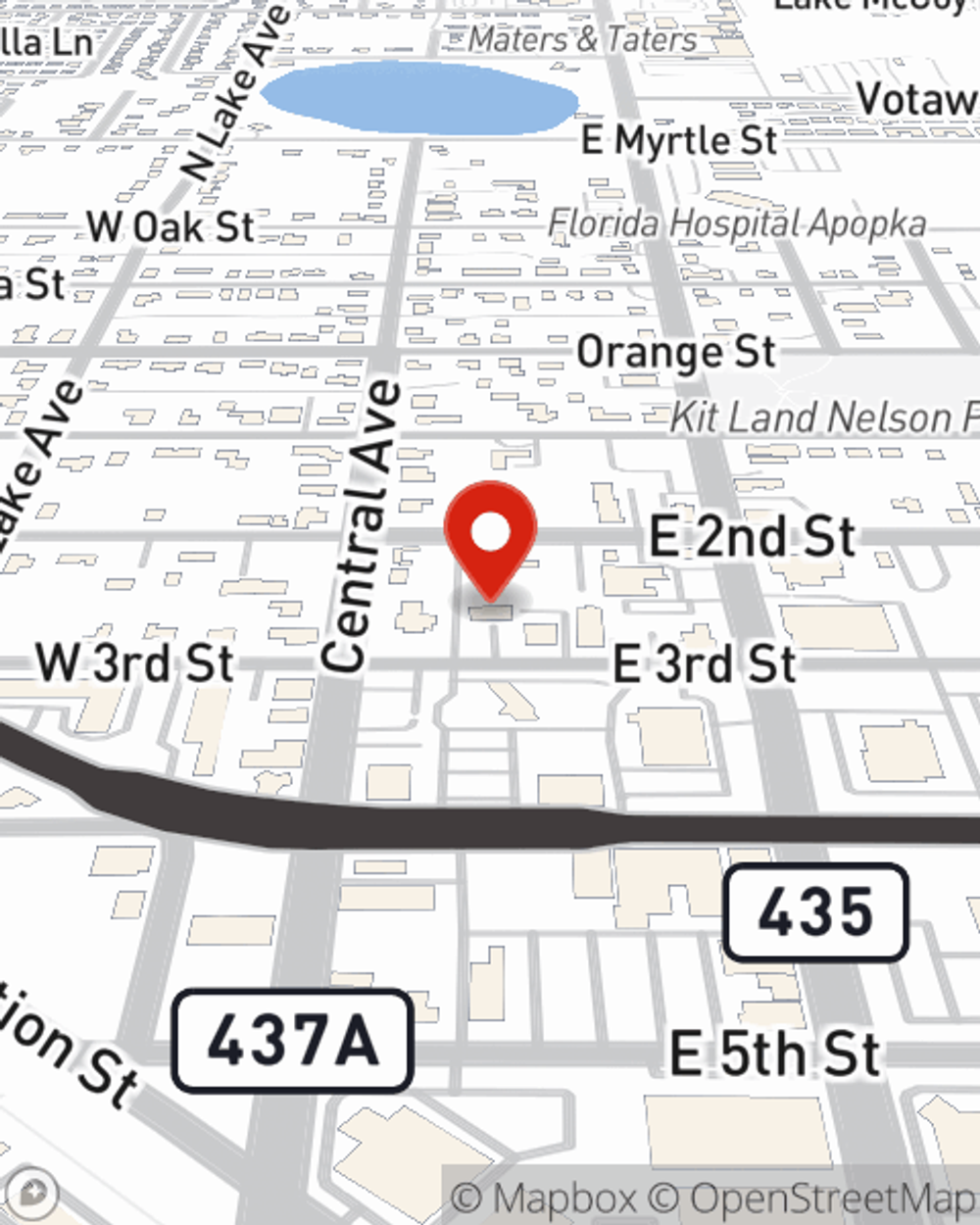

Life Insurance in and around Apopka

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

No one likes to focus on death. But taking the time now to plan a life insurance policy with State Farm is a way to express love to your partner if you're gone.

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Wondering If You're Too Young For Life Insurance?

Having the right life insurance coverage can help loss be a bit less debilitating for those closest to you and allow time to grieve. It can also help cover bills and other expenses like home repair costs, medical expenses and grocery bills.

When you and your family are protected by State Farm, you might sleep well at night knowing that even if the worst comes to pass, your loved ones may be covered. Call or go online now and see how State Farm agent Shren Yeager can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Shren at (407) 880-3167 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Shren Yeager

State Farm® Insurance AgentSimple Insights®

What is survivorship universal life insurance?

What is survivorship universal life insurance?

Survivorship universal life insurance can be used for legacy/estate planning, business transitions, charitable giving and more.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.